Sales Tax In Malaysia

With effect from 1 january 2019 registered manufacturers are able to claim the following amount of sales tax deduction on the taxable raw materials components or packaging materials acquired from local traders and used solely in the manufacturing of their taxable goods.

Sales tax in malaysia. Government collects sales tax at the manufacturer s level only and the element of sales tax embedded in the. In malaysia it is a mandatory requirement that all manufacturers of taxable goods are licensed under the sales tax act 2018. Malaysia sales tax 2018. Facilities under the sales tax act 1972.

This website is developed to enable the public to access information related to the royal malaysian customs department includes corporate information organization and customs related matters such as sales and service tax sst. Sales tax is charged by registered manufacturers of taxable goods and on the importation of taxable goods into malaysia. In cars local news by gerard lye 5 june 2020 6 29 pm 49 comments. Frequently asked questions faq sales tax 2018 sales tax 1.

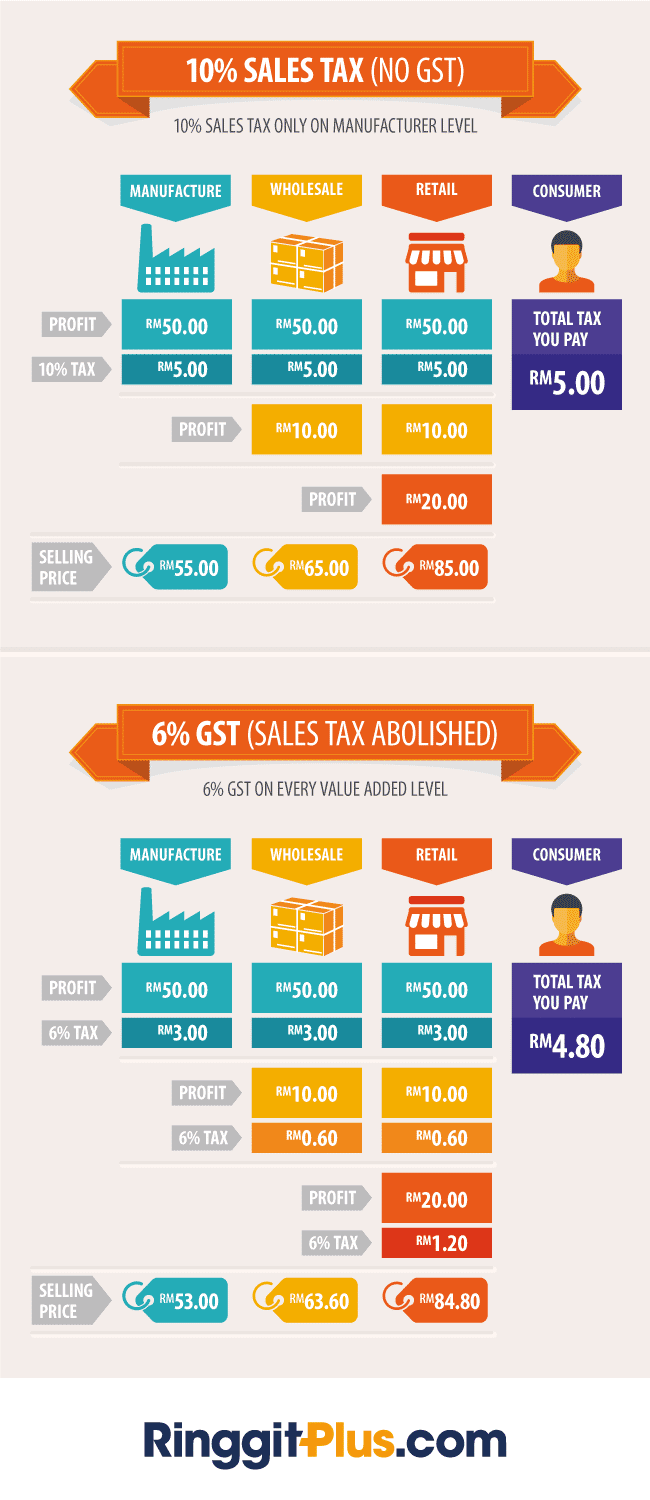

On taxable goods manufactured in malaysia by a taxable person and sold by. Sales tax in malaysia is a single stage tax imposed at the manufactures level. What is sales tax. As a general rule goods are subject to sales tax at a rate of 10 however some goods are taxed at the reduced rate of 5 specific rates and others are specifically exempt.

The raw material or components use in the manufacture of taxable. In the case of locally manufactured taxable goods sales tax is levied and charge on the finished goods when such finished goods are sold or disposed of. 100 sales tax exemption for ckd cars in malaysia does this mean car prices will go down by 10. Under the new sales tax and service tax framework announced on 16 july 2018 sales tax is levied on the production of taxable goods in malaysia and the importation of taxable goods into malaysia at a rate of 5 or 10 or a fixed percentage depending on the category of goods.

Combined with the 10 sales tax tax charges for cars can come up to quite a substantial amount making malaysia one of the countries with the highest tax on cars globally. The sales tax a single stage tax was levied at the import or manufacturing levels. Following the announcement of the re introduction of sales and services tax sst that will kick start on 1 september 2018 the royal malaysian customs department rmcd has recently announced the implementation framework of sst as well as a detailed faqs to arm malaysians with sufficient knowledge of the new tax regime before sst commence.