Sbi Bank Home Loan Interest Rate

As updated on.

Sbi bank home loan interest rate. Sbi home loan interest rate is 6 95 p a. Currently sbi offering lowest home loan rates in indian market. Sbi home loan interest rates reduced by 10 bps. Ebr 35 bps er.

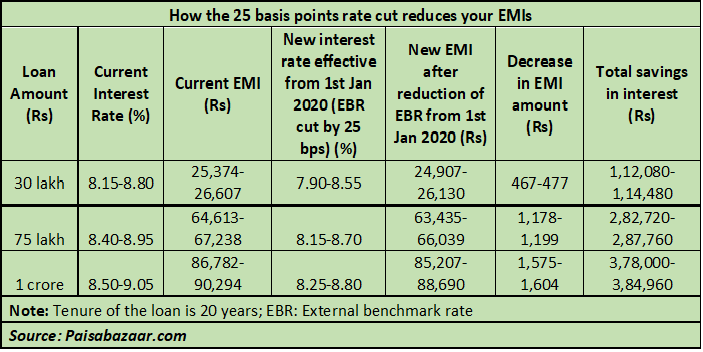

State bank of india offers attractive interest rates on home loans starting at 6 95 p a. Effective rate ebr 70 bps. Sbi s rllr has dropped from 8 00 to 7 65. For most banks including sbi it is based on rbi repo rate and is called the external benchmark based rate ebr.

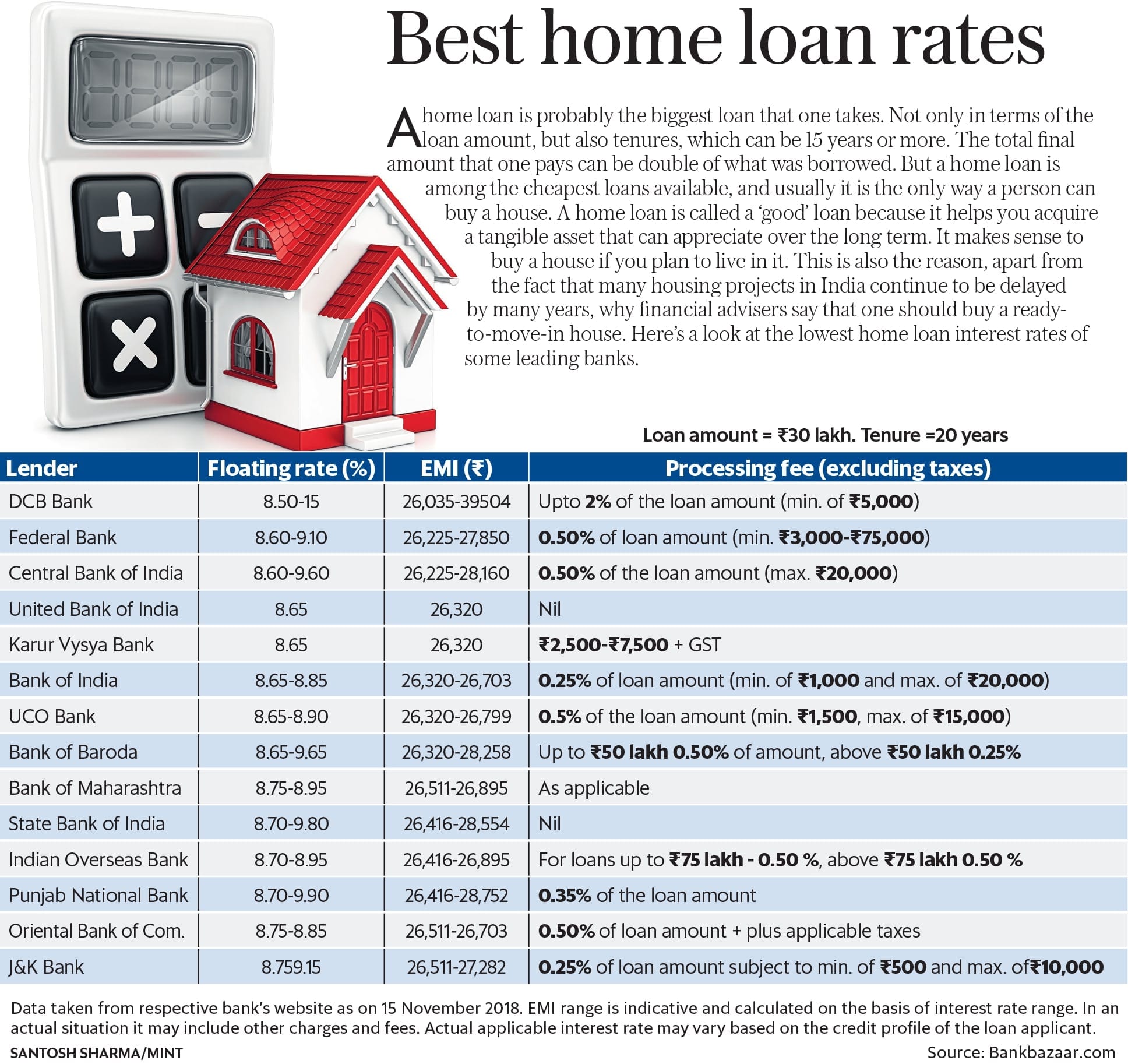

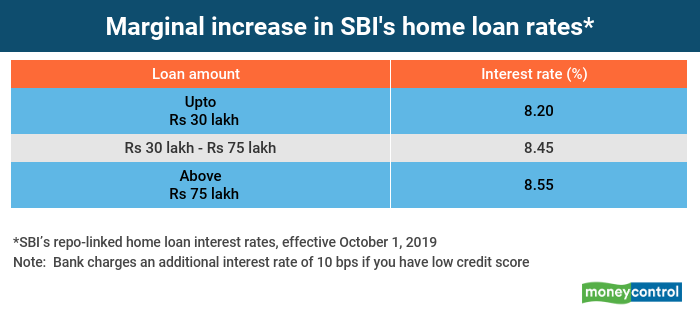

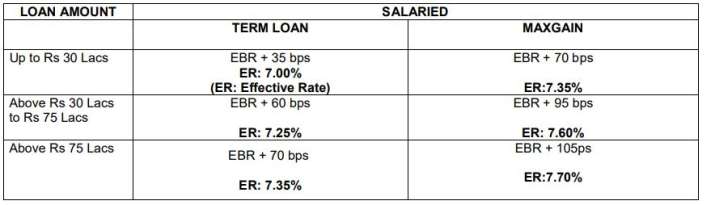

Floating interest card rates w e f 01 07 2020 a home loan interest card rate structure floating. Country s largest public sector lender state bank of india sbi has slashed the interest rates on personal gold loans. Max rs 10 000 plus applicable taxes women borrowers are also offered an interest concession of 0 05 on sbi home loans. Transferring the benefits of rbi repo rate cut state bank of india has slashed interest rates on housing loans up to 30 lakh by 10 basis points at 8 60 to 8 90 per annum.

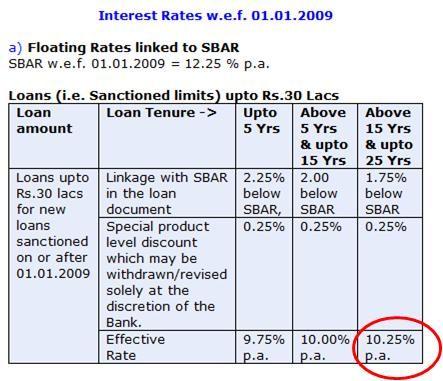

Flexipay home loan calculator. Welcome to the largest and most trusted home loan provider in india. From oct 1 2019 the home loan interest rate of the state bank of india has reduced from 8 40 to 8 05 p a. This variant of sbi home loan is very useful for young salaried between 21 45 years.

Up to rs 30 lacs. The bank is the first to link its term loans to the reserve bank of india s rbi repo rate in july 2019. You can browse through our range of home loan products check your eligibility and apply online. State bank of india wants you to be secure.

This is the twelfth consecutive reduction in bank s mclr. State bank of india the country s biggest lender on thursday may 7 slashed its key lending rates by 0 15 or by 15 basis points across all tenors home auto loans cheaper for existing customers following the cut one year mclr will come down to 7 25 per annum from 7 40 per annum with effect from may 10 the lender said. As of now sbi home loan rate is linked to marginal cost based lending rate mclr. Mclr slashed by 5bps across tenors.

If you come across any such instances please inform us. The mclr across tenors is reduced by 5 basis points. Sbi s repo linked home loan rates decrease to 8 05 from october 1. We also have a large number of sbi pre approved projects that you can check out.

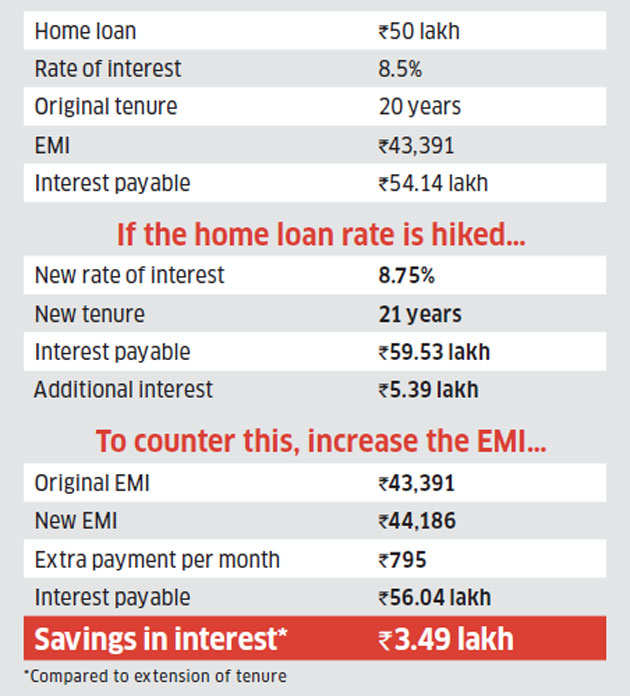

Sbi flexipay home loan provides an eligibility for a greater loan. It offers customer the flexibility to pay only interest during initial 3 5 years and thereafter in flexible emis. The interest rates which were 7 75 earlier has now been reduced to 7 5 annually. A customer can avail a loan of up to rs 50 lakh by pledging gold articles under the scheme.

The loan tenure can be extended up to 30 years ensuring a comfortable repayment period the processing fee on these loans is 0 35 of the loan amount min. Loan amount salaried. The new interest rates are valid till september 30.