Sbi Housing Loan Interest Rates

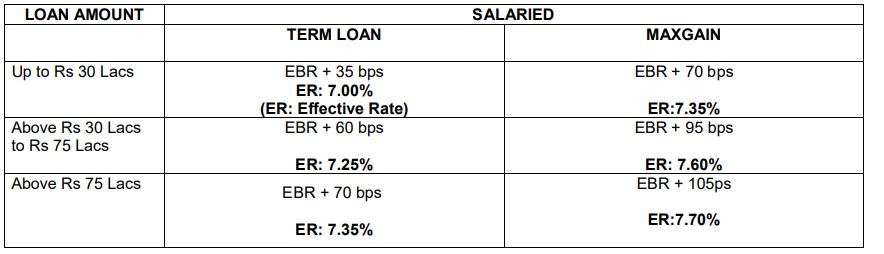

Ebr 35 bps er.

Sbi housing loan interest rates. As updated on. Lic housing finance has introduced an all time low. If you come across any such instances please inform us through e. Loan amount salaried.

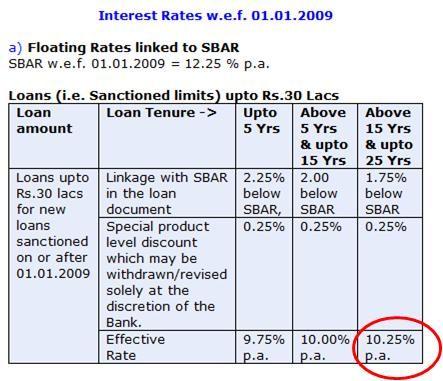

Sbi is now offering home loans from 6 95. State bank of india offers attractive interest rates on home loans starting at 6 95 p a. Country s largest public sector lender state bank of india sbi has slashed the interest rates on personal gold loans. Floating interest card rates w e f 01 07 2020 a home loan interest card rate structure floating.

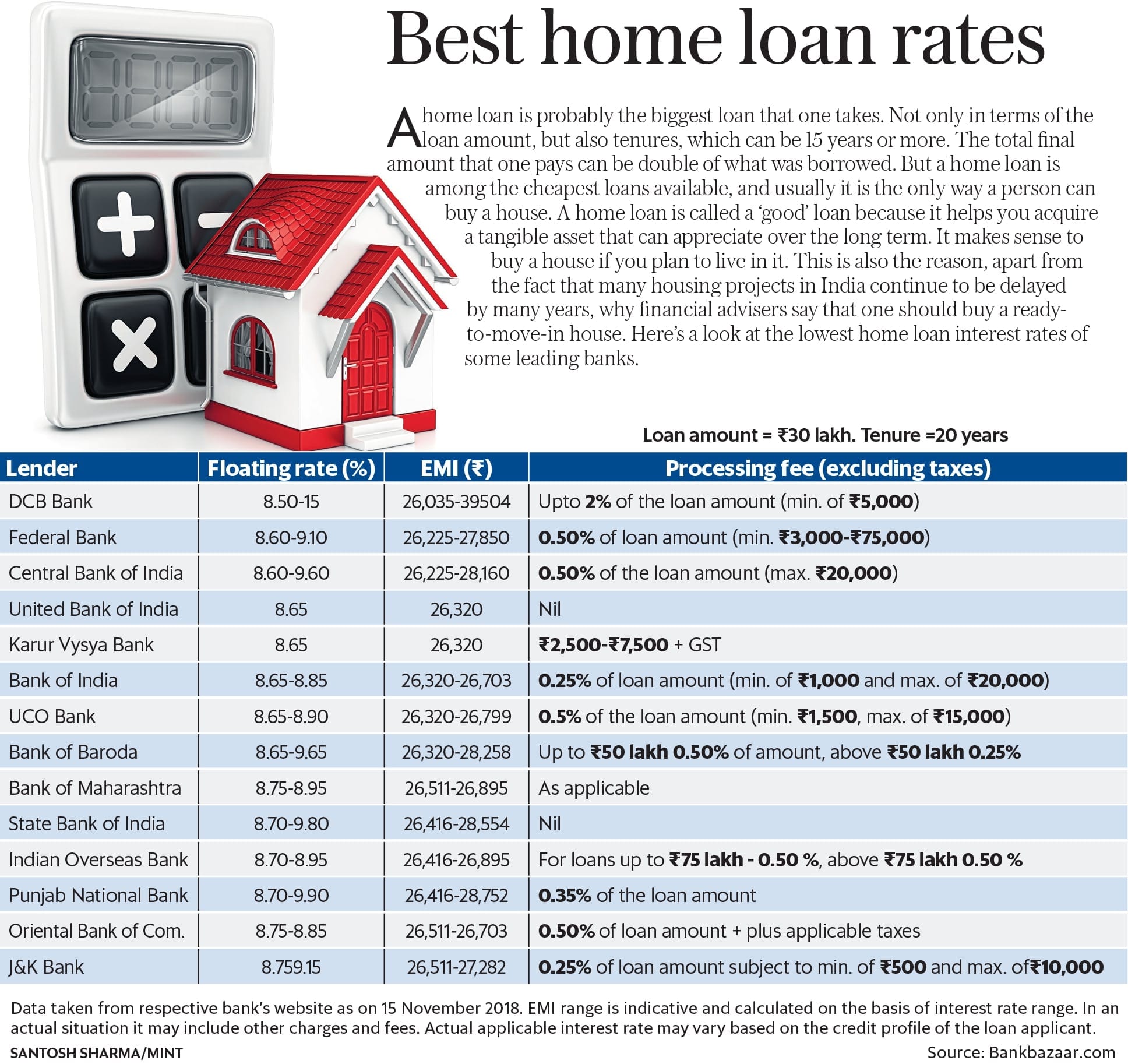

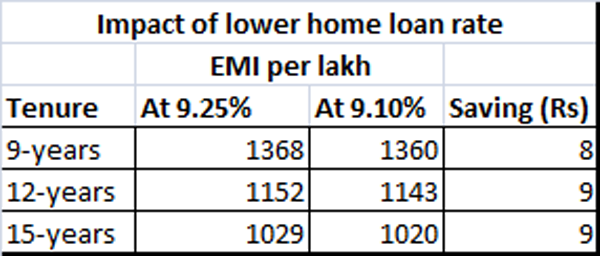

A few psu banks offer home loan rates which are at 6 7 to 7 1. Max rs 10 000 plus applicable taxes women borrowers are also offered an interest concession of 0 05 on sbi home loans. Sbi s rllr has dropped from 8 00 to 7 65. It offers customer the flexibility to pay only interest during initial 3 5 years and thereafter in flexible emis.

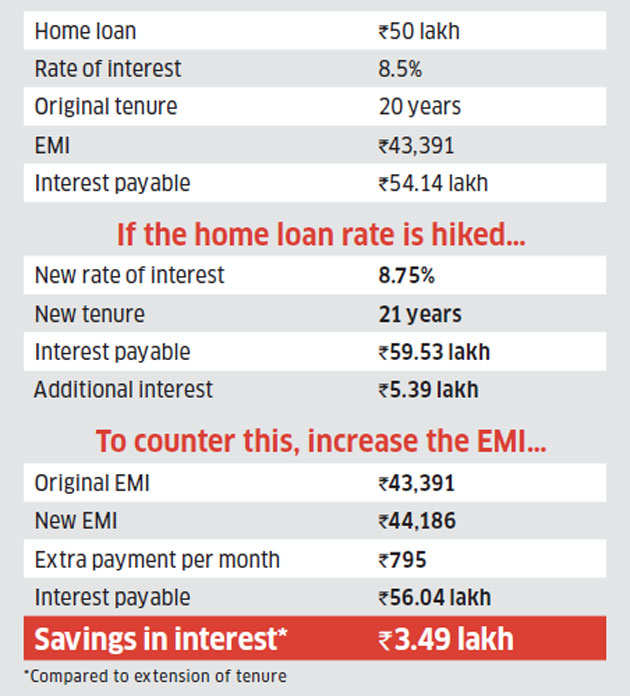

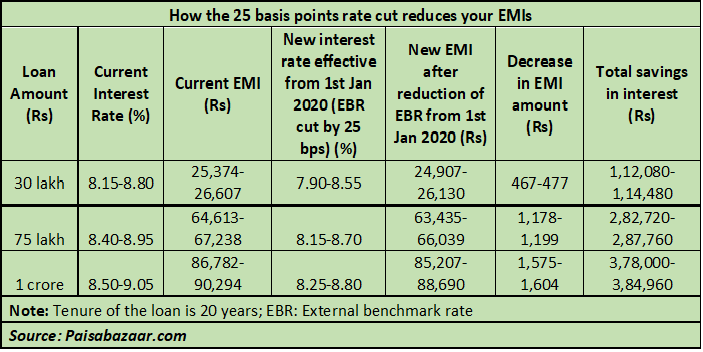

The bank is the first to link its term loans to the reserve bank of india s rbi repo rate in july 2019. The interest rates which were 7 75 earlier has now been reduced to 7 5 annually. This variant of sbi home loan is very useful for young salaried between 21 45 years. Union bank is now offering the lowest floating rates at 6 7 bank of baroda bank of india and central bank of india are at 6 85 interest.

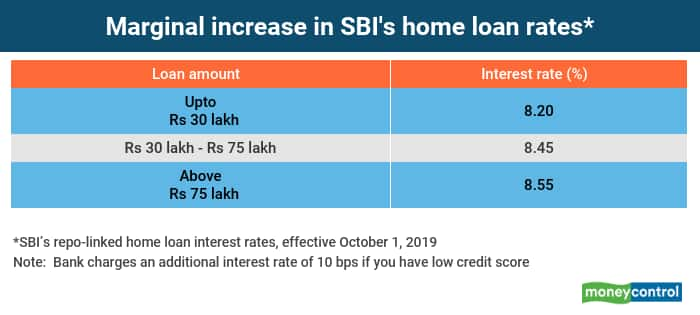

Up to rs 30 lacs. From oct 1 2019 the home loan interest rate of the state bank of india has reduced from 8 40 to 8 05 p a. Interest on cc od w e f 1st may 2019. Sbi s repo linked home loan rates decrease to 8 05 from october 1.

Marginal cost of funds based lending rate historical data penalty on premature withdrawal of deposits from 01 04 2017. A customer can avail a loan of up to rs 50 lakh by pledging gold articles under the scheme. Sbi flexipay home loan provides an eligibility for a greater loan. Flexipay home loan calculator.

State bank of india wants you to be secure. Savings bank interest rates for 10 years. Lic housing finance s rates are even better. A quarter of sbi s home loan customers in terms of the total home loan portfolio of rs 3 72 lakh crore has clung to the old base rate regime that charges higher interest rate.

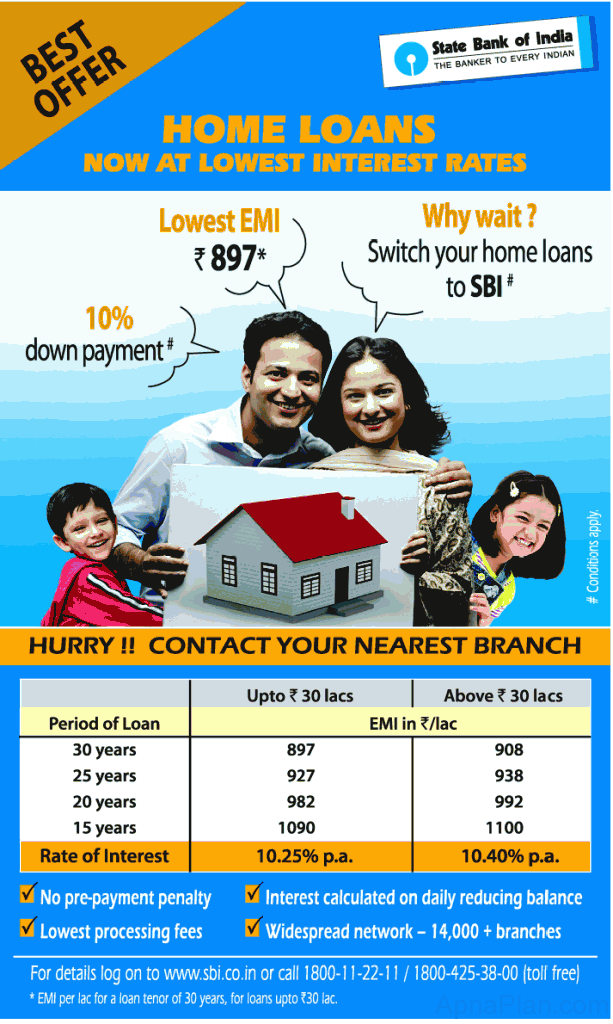

State bank of india offers a rate of 6 95 7 0 per cent on home loans up to rs 30 lakh. The loan tenure can be extended up to 30 years ensuring a comfortable repayment period the processing fee on these loans is 0 35 of the loan amount min.