Secretarial Fee Tax Deduction Malaysia 2018

Secretarial fee the deduction shall be allowed with effect from ya 2015.

Secretarial fee tax deduction malaysia 2018. Secretarial fee charged in respect of secretarial services provided by a company. Chartered tax institute of malaysia 225750 t e ctim tech dt 89 2014 18 december 2014 to all members technical direct tax income tax deduction for expenses in relation to secretarial fee and tax filing fee rules 2014 p u. The new 2020 rules are effective from ya. Malaysia taxation and investment 2018 updated april 2018 3 principal hubs the government has issued detailed guidelines including the revised guidelines for principal hubs dated 7 july 2017 for tax incentives to promote the establishment of principal hubs in malaysia.

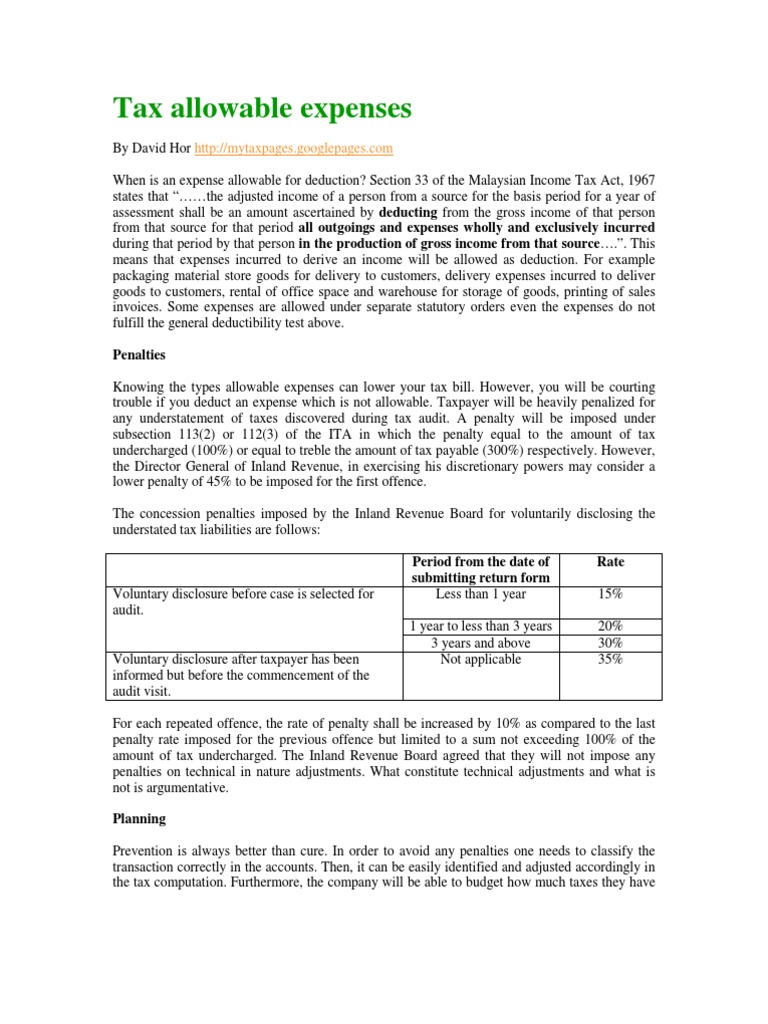

Section 26 of the sales tax act 2018. The inland revenue board irb has issued its guideline dated 8 february 2017 on the tax deductionof secretarial and tax filing fees under the income tax deduction for expenses in relation to secretarial fee and tax filing fee rules 2014 the rules. Tax espresso september 2018 3 2nd amended guidelines on deduction for expenses in relation to secretarial fee and tax filing fee revised as at 17 08 2018 the inland revenue board of malaysia irbm has on 17 august 2018 issued a 2nd amended guidelines on deduction for expenses in relation to secretarial fee and tax filing fee revised as. As the clock ticks for personal income tax deadline in malaysia 2018 like gainfully employed malaysians you may have started visiting the lhdn malaysia website to do your e filing as both a proactive and precautionary measure.

For a course of study in malaysia up to tertiary level undertaken to acquire law accountancy islamic financing technical vocational industrial scientific or technological skills or. A malaysian company can claim a deduction for royalties management service fees and interest charges paid to foreign affiliates provided that these are made at arm s length and the relevant whts where applicable have been deducted and remitted to the malaysian tax authorities. A 336 are revoked. With this the income tax deduction for expenses in relation to secretarial fee and tax filing fee rules 2014 p u.

Section 19 of the tourism tax act 2017. Education fees for self. This guide is for assessment year 2017 please visit our updated income tax guide for assessment year 2019. Section 26 of the service tax act 2018.

Section 19 of the departure levy act 2019. The guideline explains the tax treatment for deductionof secretarial and filing fees.

%20order%202017-page-001.jpg)

%20for%20ya%202019-page-001.jpg)