Stamp Duty For Tenancy Agreement Malaysia 2019

Chat property malaysia author.

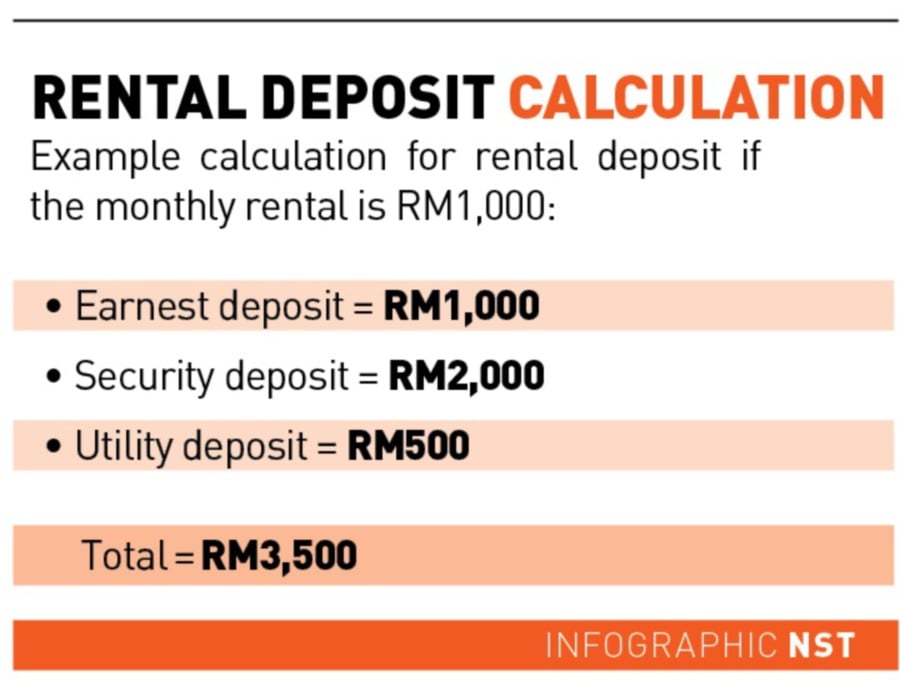

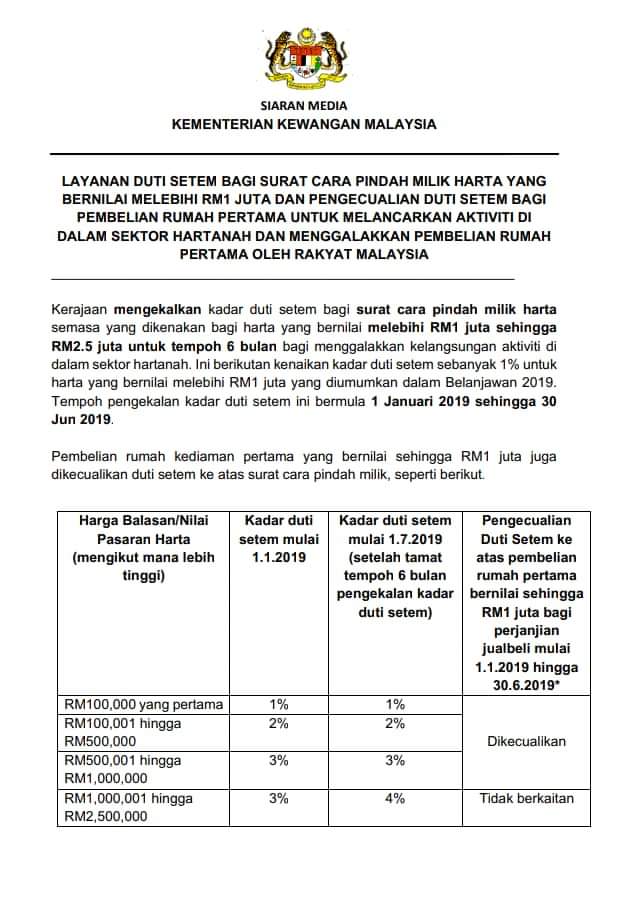

Stamp duty for tenancy agreement malaysia 2019. The stamp duty on tenancy is charged on a graduated rate so that if your rent is from one year to seven years the stamp duty payable is 0 78 percent this is not up to 1 percent the implication. Above table listed are for the main copy of tenancy agreement if you have 2nd or 3rd duplicate copy the. The amount paid would be calculated based on the annual rent. For instance the monthly rental for a one year tenancy is rm2 000 so the annual rent is rm24 000.

2019 27 411 904. As for the tenancy agreement stamp duty the amount you have to pay is depending on yearly rental and duration of the agreement. Rm24 000 rm2 400 rm21 600. The tenancy agreement will only be binding after it has been stamped by the stamp office.

Stamp duty on a loan agreement is a flat 0 5 rate applied to the full value of the loan. While paying the stamp duty there are 2 application forms which you need to submit. I got the following table from the lhdn office. About chat property malaysia.

It s also important to factor in the stamp duty owed for any loan agreement which may be entered into as part of a property purchase. For this purpose the collector may require the instrument to be fully furnished with all other necessary or supporting documents of evidence. To use this calculator. As an important legal document the loan agreement is also liable for stamp duty.

Penalty stamp duty. Rm500 billion in debt is the malaysian government bankrupt. Can i print the digitally signed tenancy agreement and use it for stamp duty at the tax office. And if the tenancy agreement has been signed for more than 3 years the stamp duty rate will be rm3 for every rm250 of the annual rent in excess of rm2 400.

April 17 2019 at 4 01 pm. Ringgit malaysia loan agreements generally attract stamp duty at 0 5 however a reduced stamp duty liability of 0 1 is available for rm loan agreements or rm loan instrument without security and repayable on demand or in single bullet repayment. Pds 1 and pds 49 a. Home calculators tenancy agreement stamp duty calculator.

Chat property malaysia. The formula for calculating that stamp duty will be. All instruments chargeable with duty and executed by any person in malaysia shall be brought to the collector who shall assess the duty chargeable. Stamp duty on a loan agreement.

How to open trading and cds account for trading in bursa malaysia. Tenant period is start from june 2019 till june 2020 may i write date of tenancy at 15th apr 2019 and go for stamping on apr 19. In summary the stamp duty is tabulated in the table below.