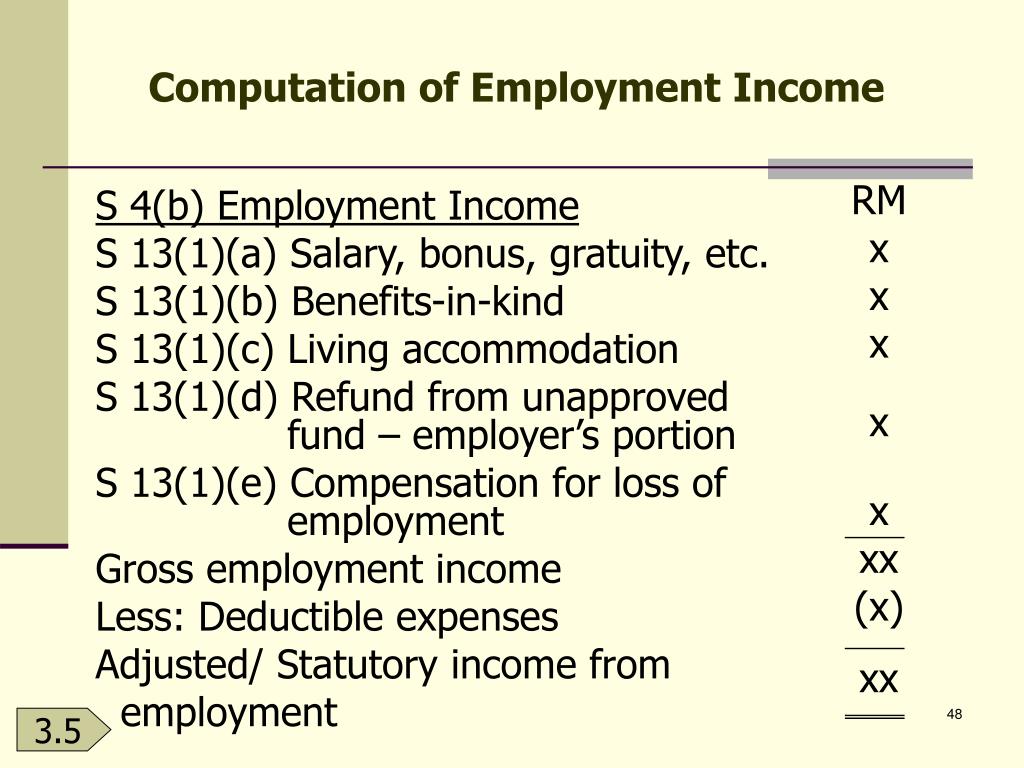

Statutory Income From Employment

Instead file a separate schedule c for each type of income.

Statutory income from employment. Income of preceding years not declared 22 part h. In addition if the person didn t have income tax withheld on statutory employee income they must schedule se to report income tax liability and social security medicare tax not withheld and payable from wages and tips from form w 2. Particulars of executor of the deceased person s estate 22 declaration 23 particulars of tax agent who completes this return form 23 reminder 23 part 2 working sheets hk 2 computation of statutory income from employment 24 hk 2 1 receipts under paragraph 13 1 a 26. Withhold social security and medicare taxes from the wages of statutory employees if all three of the following conditions apply.

The irs allows employers to treat several categories of workers as statutory employees. A statutory employee s business expenses are not subject to the reduction of 2 of their adjusted gross income. The weekly rate for statutory sick pay is 95 85 for up to 28 weeks. Social security and medicare tax should have been.

For a standard independent contractor an employer cannot withhold taxes. Do not combine statutory employee income with self employment income. Refer to the salesperson section located in publication 15 a employer s supplemental tax guide for additional information. Statutory income is also reffered to as take home pay as it is the amount of money you take home after all deductions.

Statutory and self employment income on form w 2 the employer checks box 13 to notify the irs that an employee is considered a statutory employee. Social security and medicare taxes. A statutory nonemployee is a worker classification that aligns with independent contractors. To qualify for sick pay you must work for an employer and earn on average at least 120 per week 6 240 per year.

And businesses do not need to pay employer taxes like futa tax on their wages. This includes drivers paid on commission insurance sales agents a home based worker for whom you furnish. Do not carry net statutory income to schedule se. Statutory income is the combined income of any person from all sources remaining after allowing for the appropriate deductions and exemptions given under the income tax act.

Businesses that employ statutory nonemployees do not need to withhold federal income or fica social security and medicare taxes from their wages.