Type Of Unit Trust

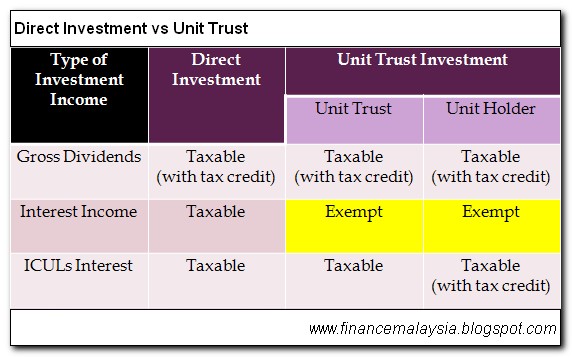

It states how much interest was earned during the tax year.

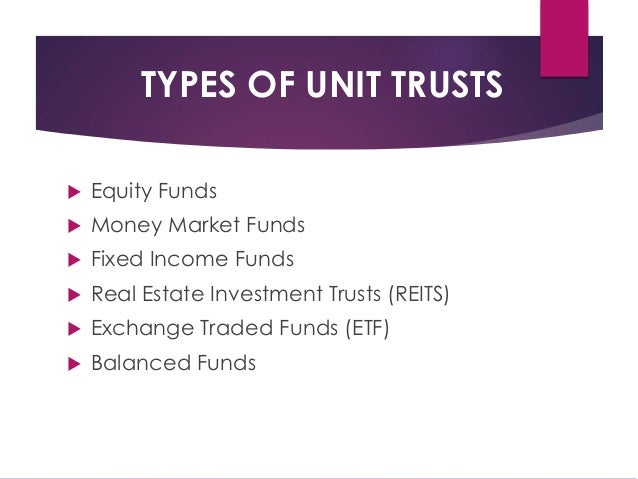

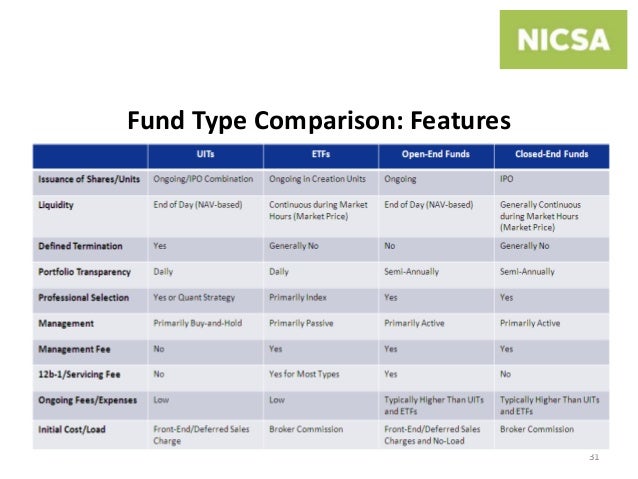

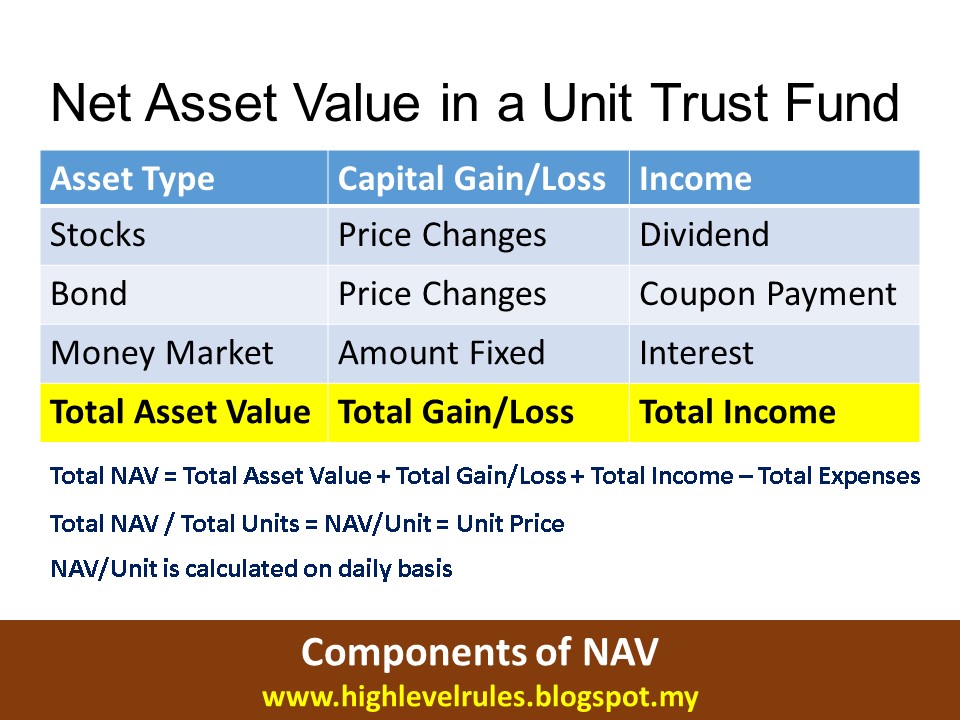

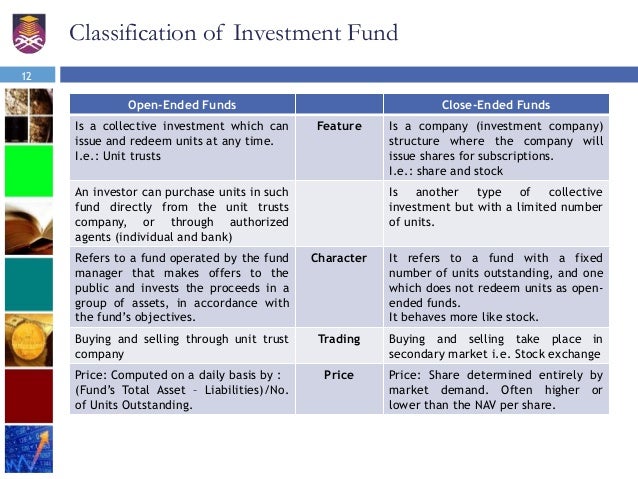

Type of unit trust. Unit trusts are typically classified by geography sector and type of assets held. A unit trust is a type of collective investment packaged under a trust deed. A unit trust pools investors money into a single fund which is managed by a fund manager. Unit trusts provide access to a vast range of securities.

Unit trusts are subject to two types of taxes. Well that depends on the type of unit trust you invest in. Types of unit trusts. The next step is choosing the right type of fund that suits your needs.

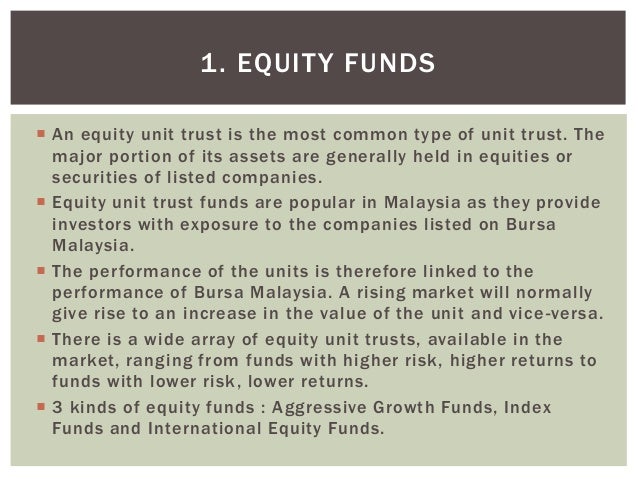

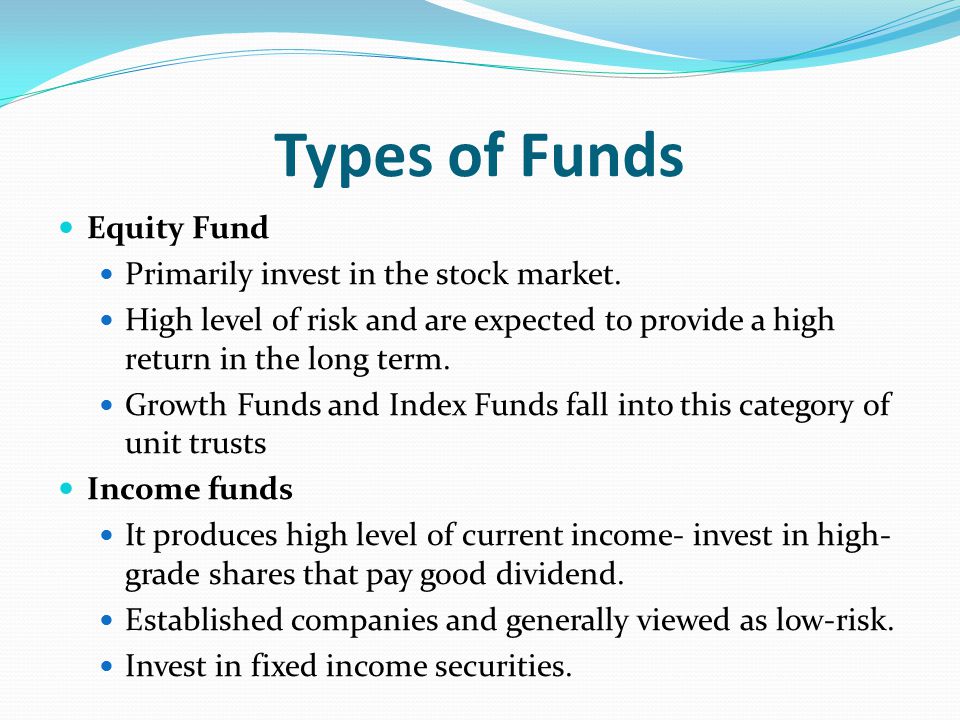

Let us explain the etf killer is a special kind of new generation unit trust and this low cost well managed unit trust is just one of the two top unit trust investments i ve revealed in my new report the best unit trusts to invest in today starting from just r500. Unit trusts are an accessible flexible and straightforward investment making them one of the easiest ways to grow wealth. These are offered in guernsey jersey fiji ireland new. An equity unit trust is the most common type of unit trust.

At the end of the tax year your investment company will issue you with an itb3 certificate a certificate produced annually for every account that has received credit interest. A fund house s fund name would reflect these. Type of unit trusts. A unit trust is a form of collective investment constituted under a trust deed.

Equity unit trust funds are popular in malaysia as they provide investors with exposure to the companies listed on bursa malaysia. Tax income earned in the form of interest and dividends. Unit trusts offer access to a wide range of investments and depending on the trust it may invest in securities such as shares bonds gilts and also properties mortgage and cash equivalents.