What Is Credit Score Based On

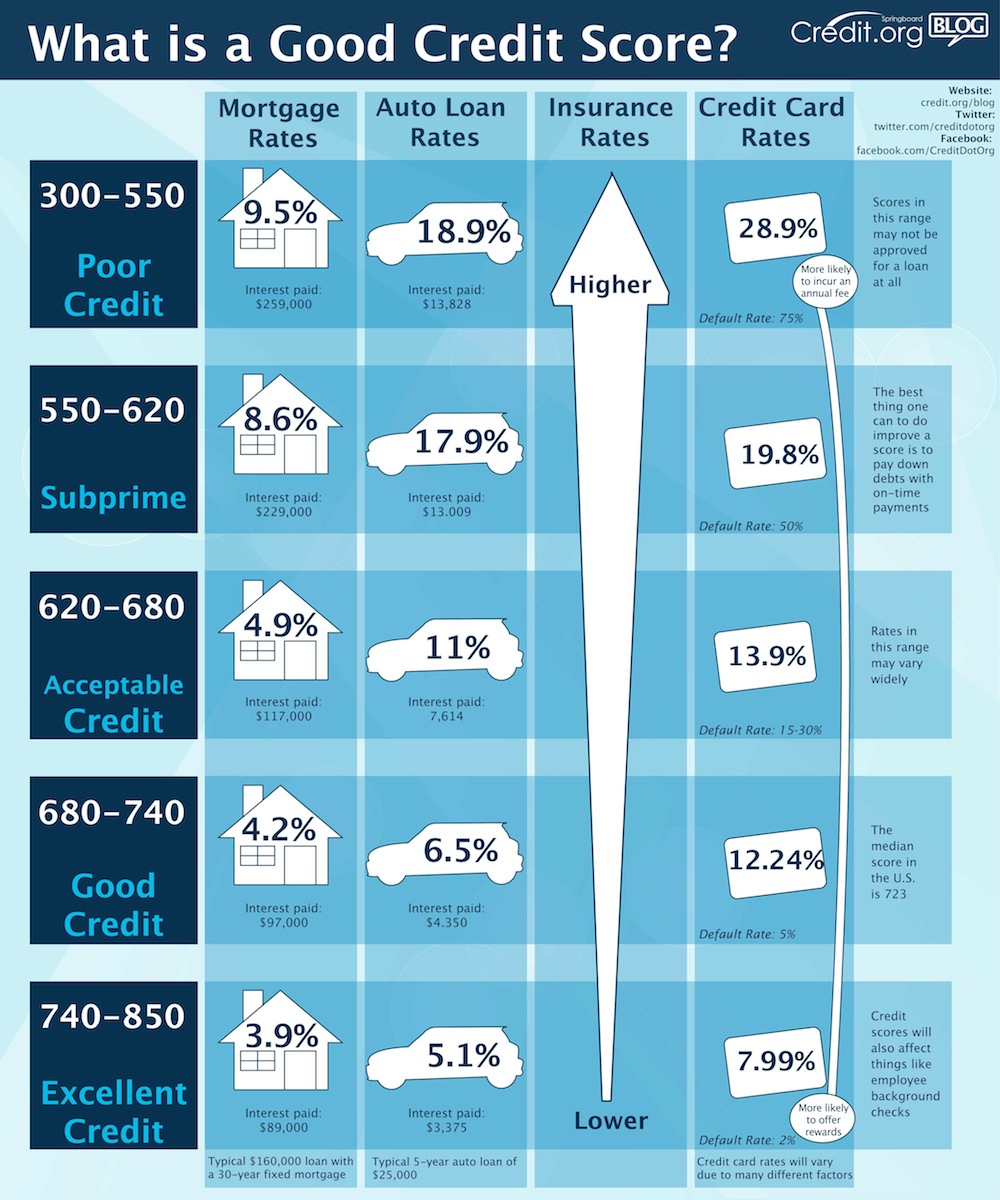

With higher scores you have a better chance of getting approved for loans and qualifying for the best interest rates available.

What is credit score based on. Number of open accounts total levels of debt and repayment history and other factors. In addition as the information in your credit report changes so. A credit score is a number evaluating your creditworthiness based on your credit history. A credit score is a numerical expression based on a level analysis of a person s credit files to represent the creditworthiness of an individual.

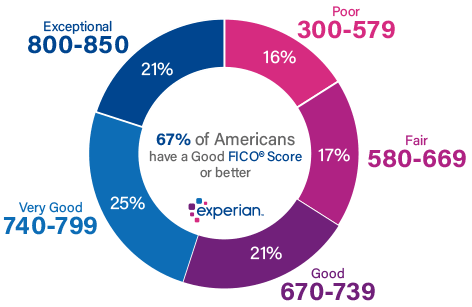

Lenders such as banks and credit card companies use credit scores to evaluate the potential risk posed by lending money to consumers and to. For example a lender might automatically approve individuals with a fico score of 740 while scores between 670 and 739 may put borrowers on the hook for higher interest rates and those with scores lower than 580 may not receive approval. Your credit score changes frequently and it is up to each lender how they interpret and use your credit score. What is a credit score.

A credit score is based on credit history. Credit scores determine a person s ability to borrow money for mortgages auto loans and even private loans for college. For example scores for people who have not been using credit long will be calculated differently than those with a longer credit history. Lenders use credit scores to evaluate the probability that an.

A credit score is a tool used by lenders to help determine whether you qualify for a particular credit card loan mortgage or service. Your credit score is used by lenders to predict the likelihood that you will repay future debt. Using the information on your credit report and any additional information you supplied as part of your application lenders use a mathematical model to calculate a numerical score that represents your credit. Credit scores and credit based insurance scores while often considering the same credit report information are not designed to do the same things.

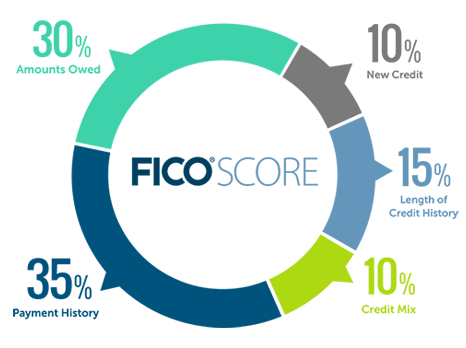

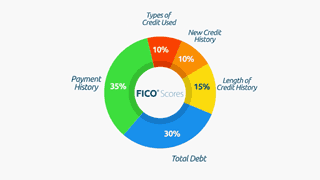

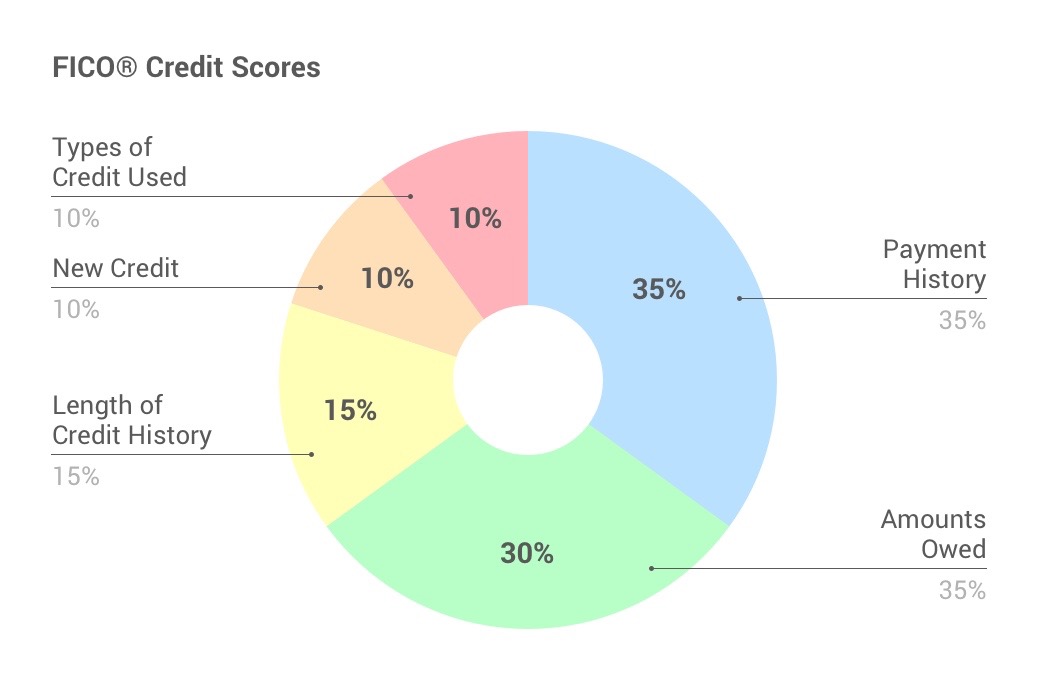

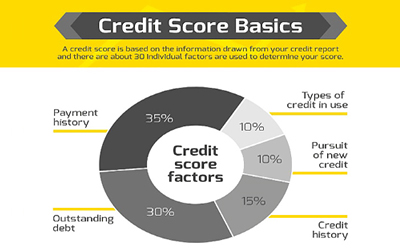

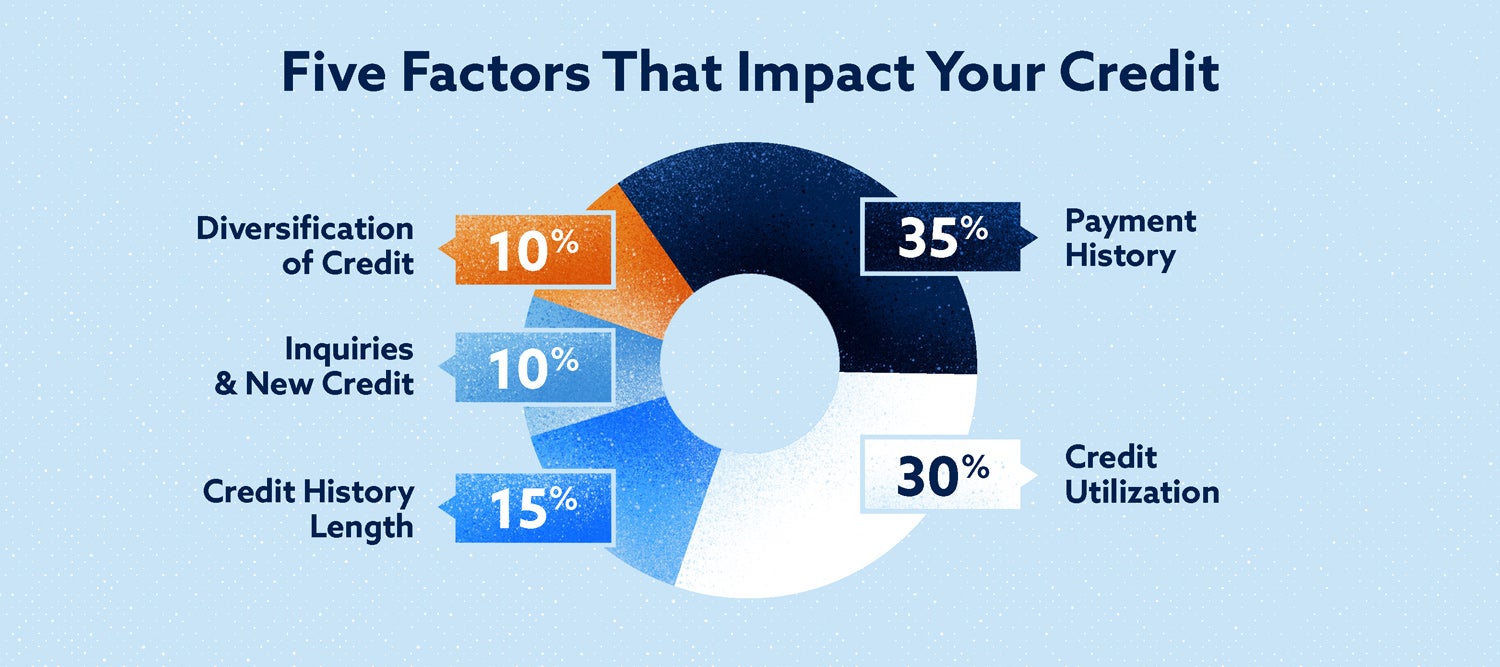

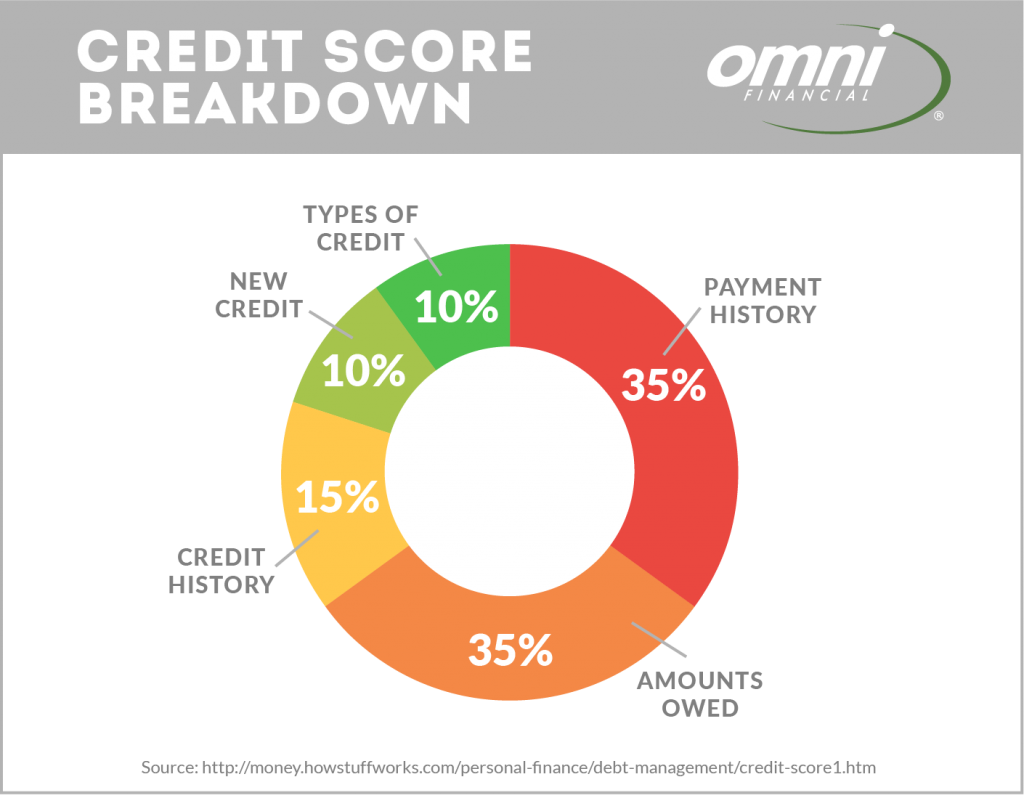

Vantagescore and fico are both popular credit scoring models. Credit scores are designed for one purpose. They are calculated based on the five categories referenced above but for some people the importance of these categories can be different. Credit scores fall in a range from 300 to 850.

But lenders may have different standards as to what credit score is acceptable for credit approval. How credit scores are created. The credit bureaus can also calculate scores for you based on their own proprietary models. The three main credit bureaus equifax experian and transunion create your credit reports which credit scoring models like vantagescore and fico use to come up with a score that typically ranges from 300 850.

/Balance_The_Fico_8_Credit_Scoring_Formula-1203b3ec26b34cc4aa2eddbee3a8bdb1.png)