What Is Gst Malaysia

The malaysian gst regime.

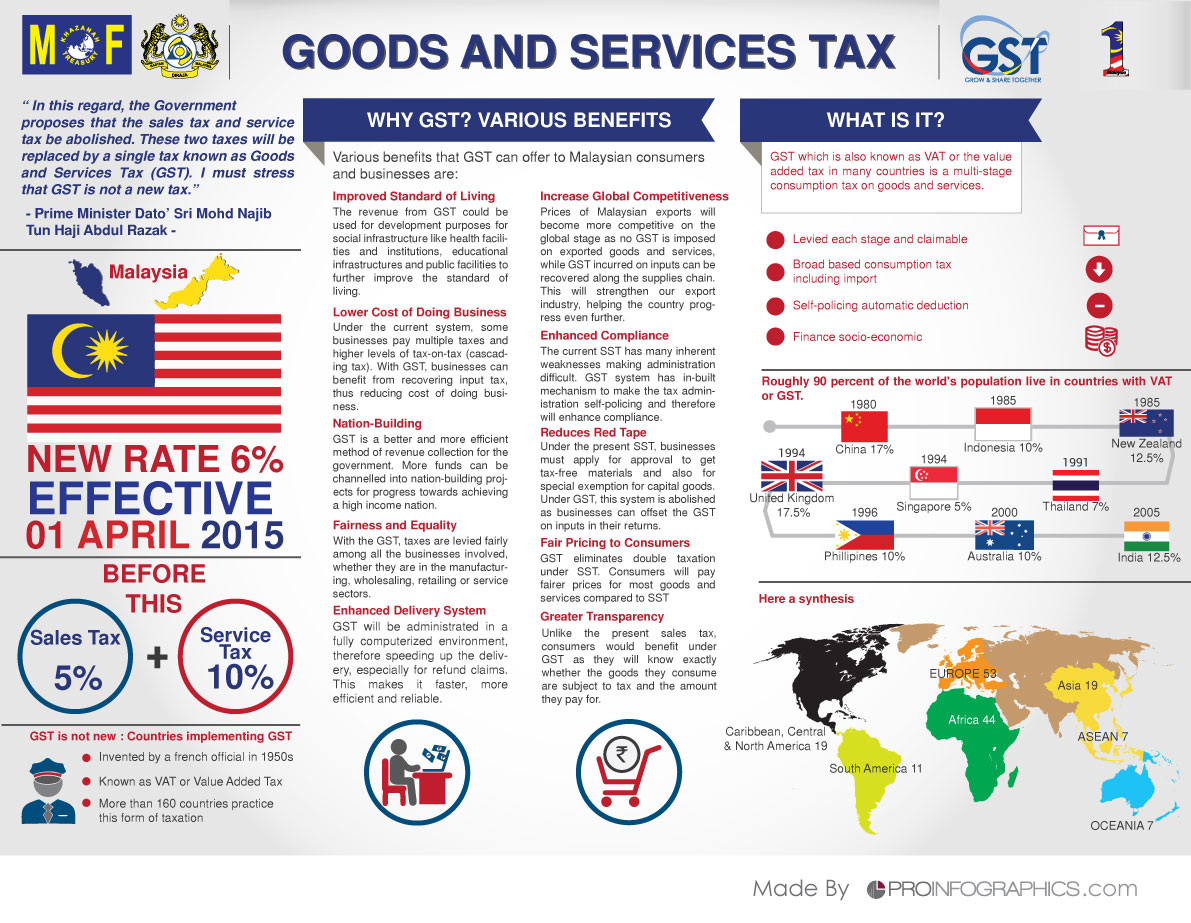

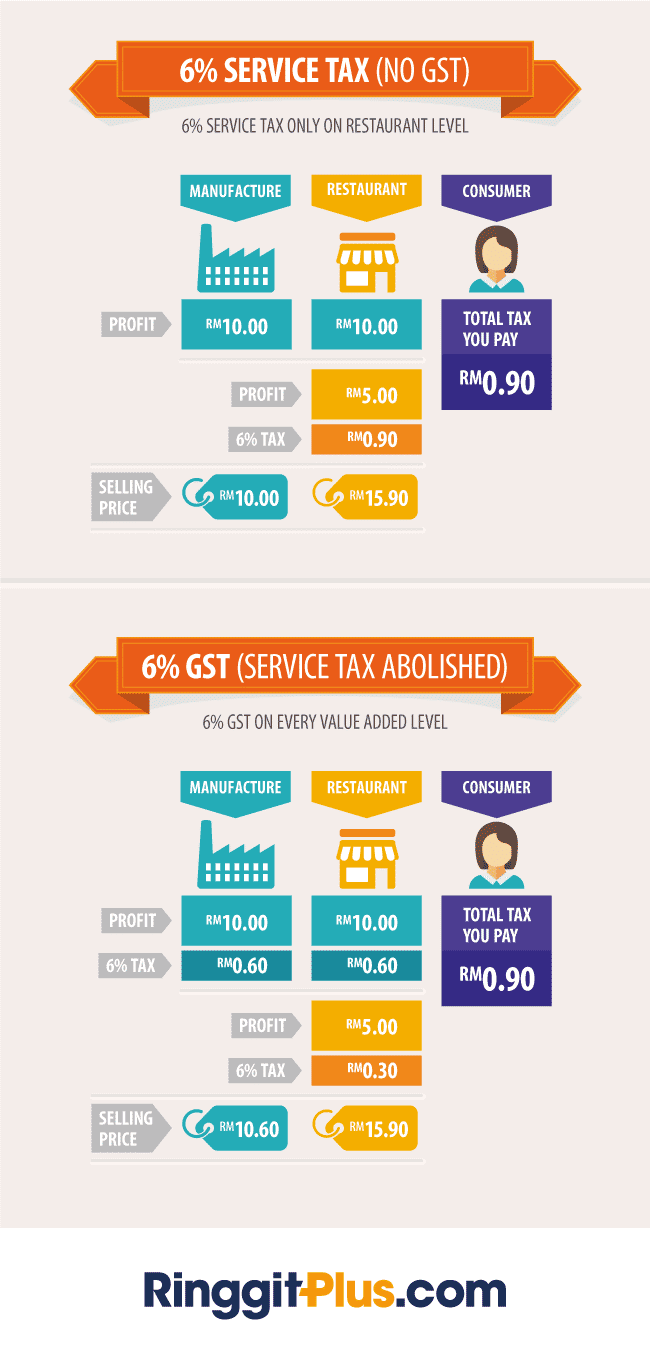

What is gst malaysia. Malaysian goods and services tax history. What is gst rate in malaysia. 20 current tax system effective on 1st april 2015 5 6 10 20 specific rate 6 gst is a replacement tax abolishment of sst. For many people there is no need to change an effective system with another system that is not working for the economy.

Malaysia was relying on a workable taxing system for decades and this has been helping the economy without relying on gst. In malaysia gst is charged on imported goods scope of gst test of gst. Crowds flock to malaysia malls as gst drops to zero. In malaysia the goods and services tax gst was introduced on april 1 2015.

Same same but different. How to calculate malaysian gst manually. The goods and services tax gst is an abolished value added tax in malaysia gst is levied on most transactions in the production process but is refunded with exception of blocked input tax to all parties in the chain of production other than the final consumer. To modernise its taxation system and improve business efficiency malaysia replaced its sales and service tax regimes with the goods and services tax gst effective 1 april 2015.

Gst is a broad based consumption tax covering all sectors of the economy i e all goods and services made in malaysia including imports except specific goods and services which are categorized under zero rated supply and exempt supply orders as determined by the minister of finance and published in the gazette. Malaysia gst reduced to zero. Current gst rate in malaysia is 6 for goods and services. What is the impact of the change of gst to sst in malaysia.

Basic concepts and gst model 19. 21 6 standard rate. Sst will usually see lower retail rates but there may be a possible increase in certain products including the costs or charges for the services provided. Gst exceptions in malaysia.

Sales tax is based on the cost of producing or importing products so whether it is imposed on the previous tax rate of up to 10. The ministry of finance mof announced that starting from 1 june 2018 the rate of the goods and service tax gst will be reduced to 0 from the current 6 for more information regarding the change and guide please refer to.