What Is Income Tax Return

Income tax is used to fund public services pay government.

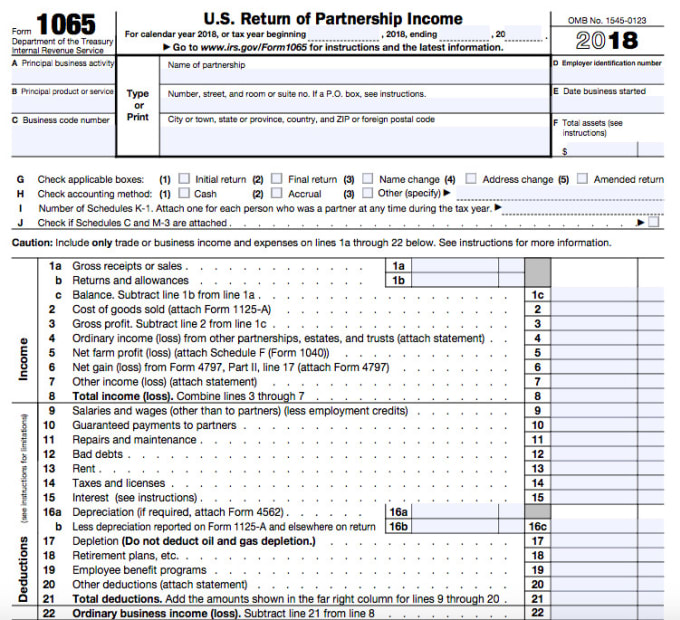

What is income tax return. In case the return shows that excess tax has been paid during a year then the individual will be eligible to receive a income tax refund from the income tax department. The trust reports its net income or loss. The income section of a tax return lists all sources of income. Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction.

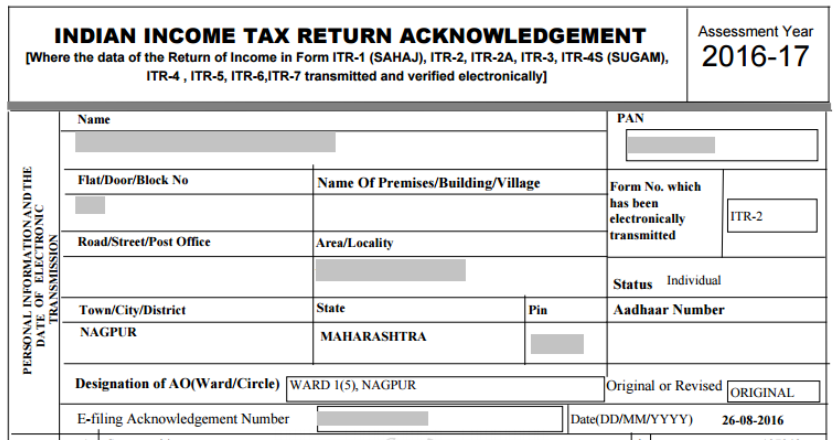

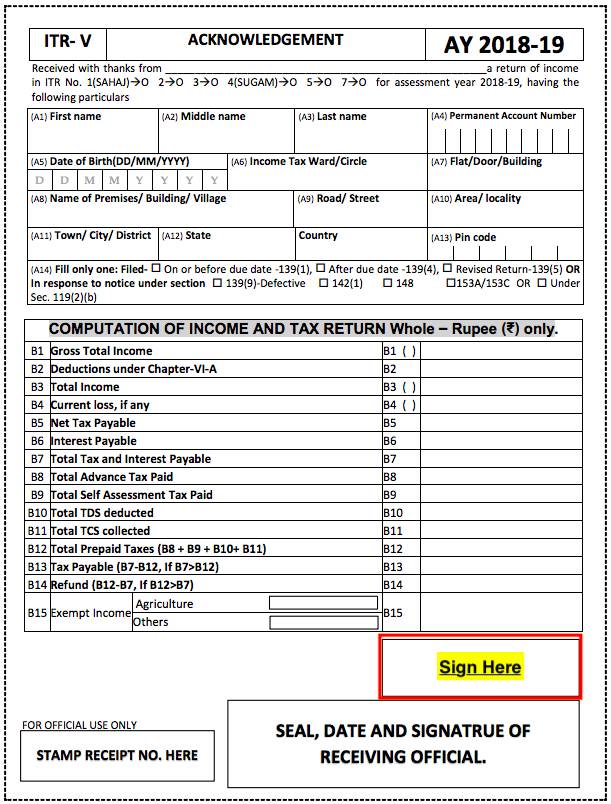

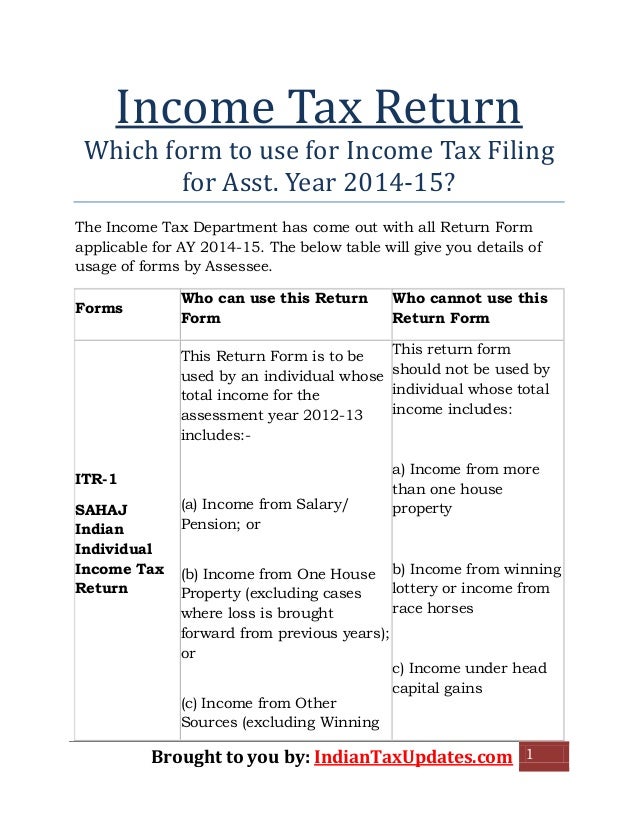

A canadian tax return consists of the reporting the sum of the previous year s january to december taxable income tax credits and other information relating to those two items. Income tax return is the form in which assessee files information about his income and tax thereon to income tax department various forms are itr 1 itr 2 itr 3 itr 4 itr 5 itr 6 and itr 7 when you file a belated return you are not allowed to carry forward certain losses. If you are the beneficiary of a trust you report on your tax return. Each trust beneficiary lodges their own tax return such as a company or individual tax return.

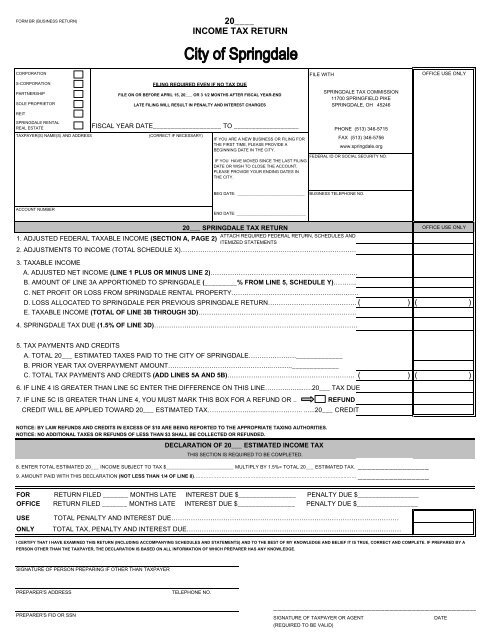

Income tax return itr is a statement of income and tax thereon which is to be furnished by a taxpayer to the income tax department in prescribed form. Wages dividends self employment income royalties and in many countries. As per the income tax laws the return must be filed every year by an individual or business that earns any income during a financial year. Annual income tax return for corporation partnership and other non individual taxpayer exempt under the tax code as amended sec.

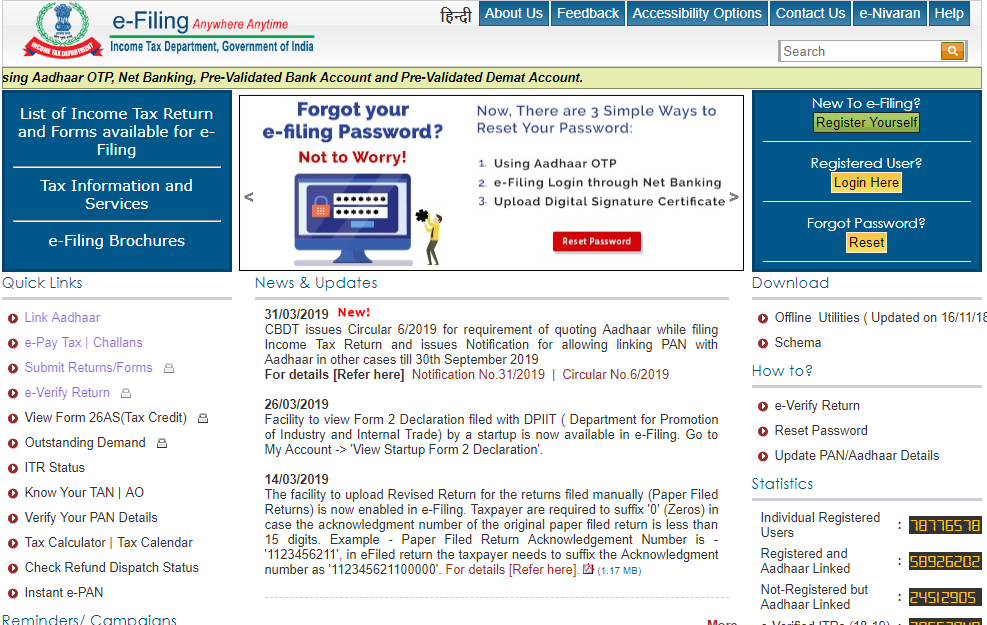

The most common method of reporting is a w 2 form. The finance ministry issued itr 1 sahai itr 2 itr 3 itr 4 sugam itr 5 itr 6 itr 7 and itr v forms. The income tax act 1961 and the income tax rules 1962 obligates citizens to file returns with the income tax. 30 and those exempted in sec.

27 c and other special laws with no other taxable income. The income tax department which has brought in some key changes in the income tax return forms has now released itr forms for the financial year 2019 20 assessment year 2020 21. This is the trust s assessable income less deductions. Any income you receive from the trust.

/w2-9ca13523f4d74e958b821aab63af2e60.png)