Section 39 1 Income Tax Act

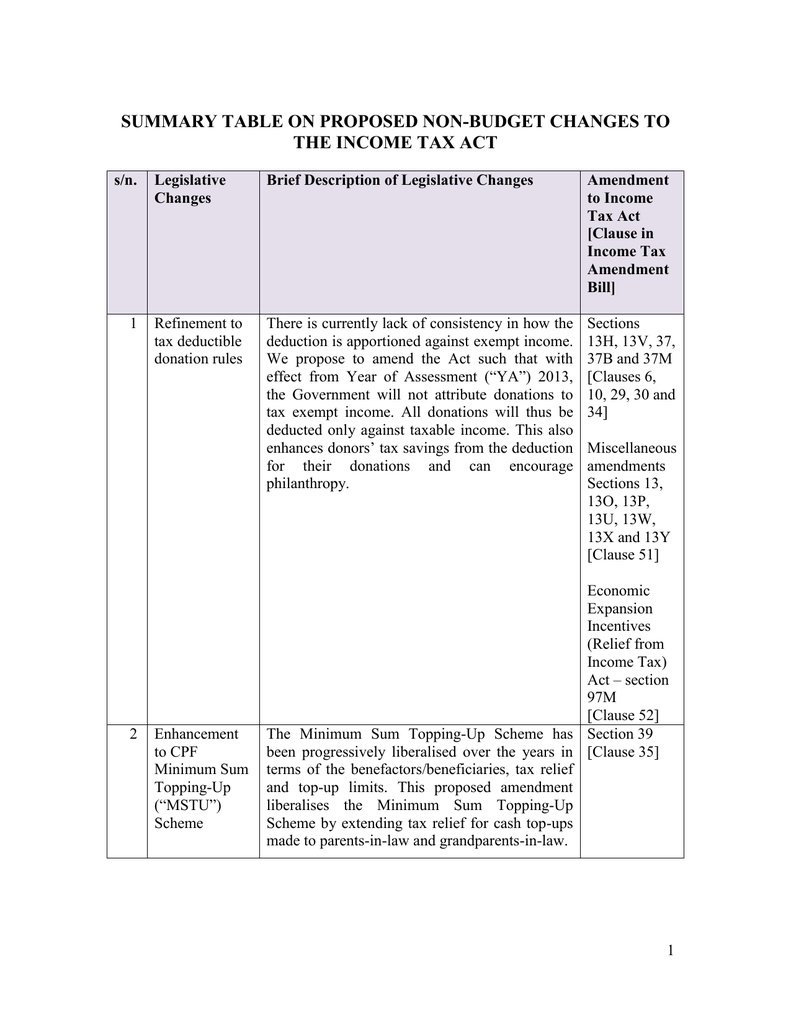

Section 4 of the amendment act extended the prohibition to assessment years governed by the 1922 act and section 5 saved certain cases.

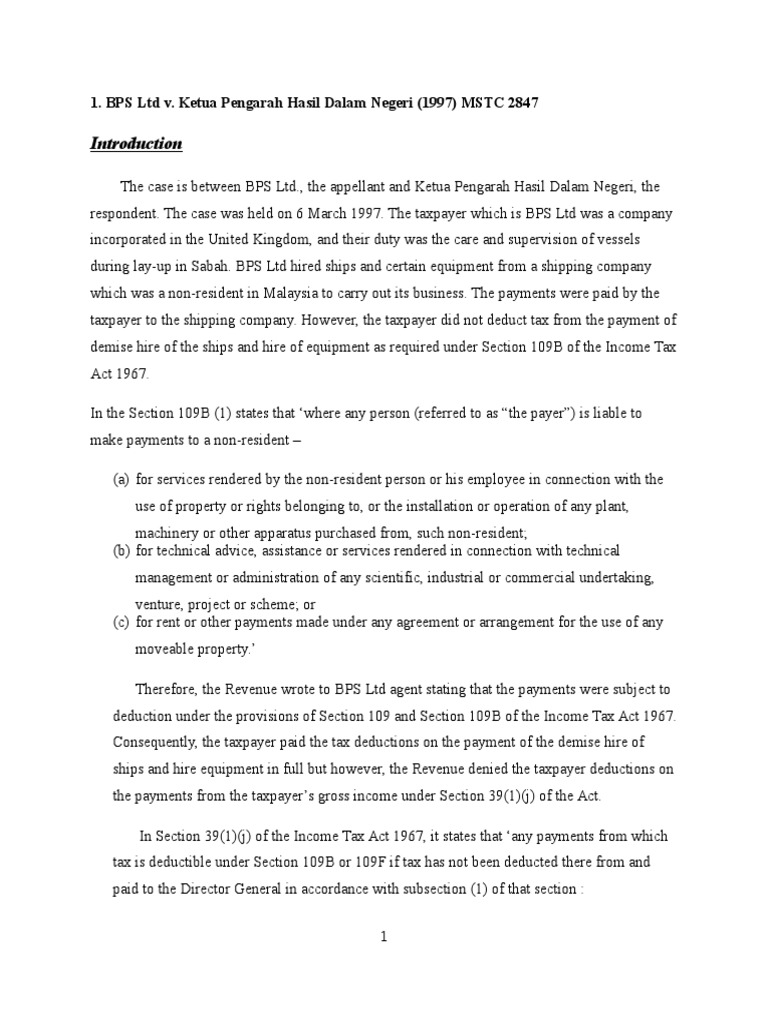

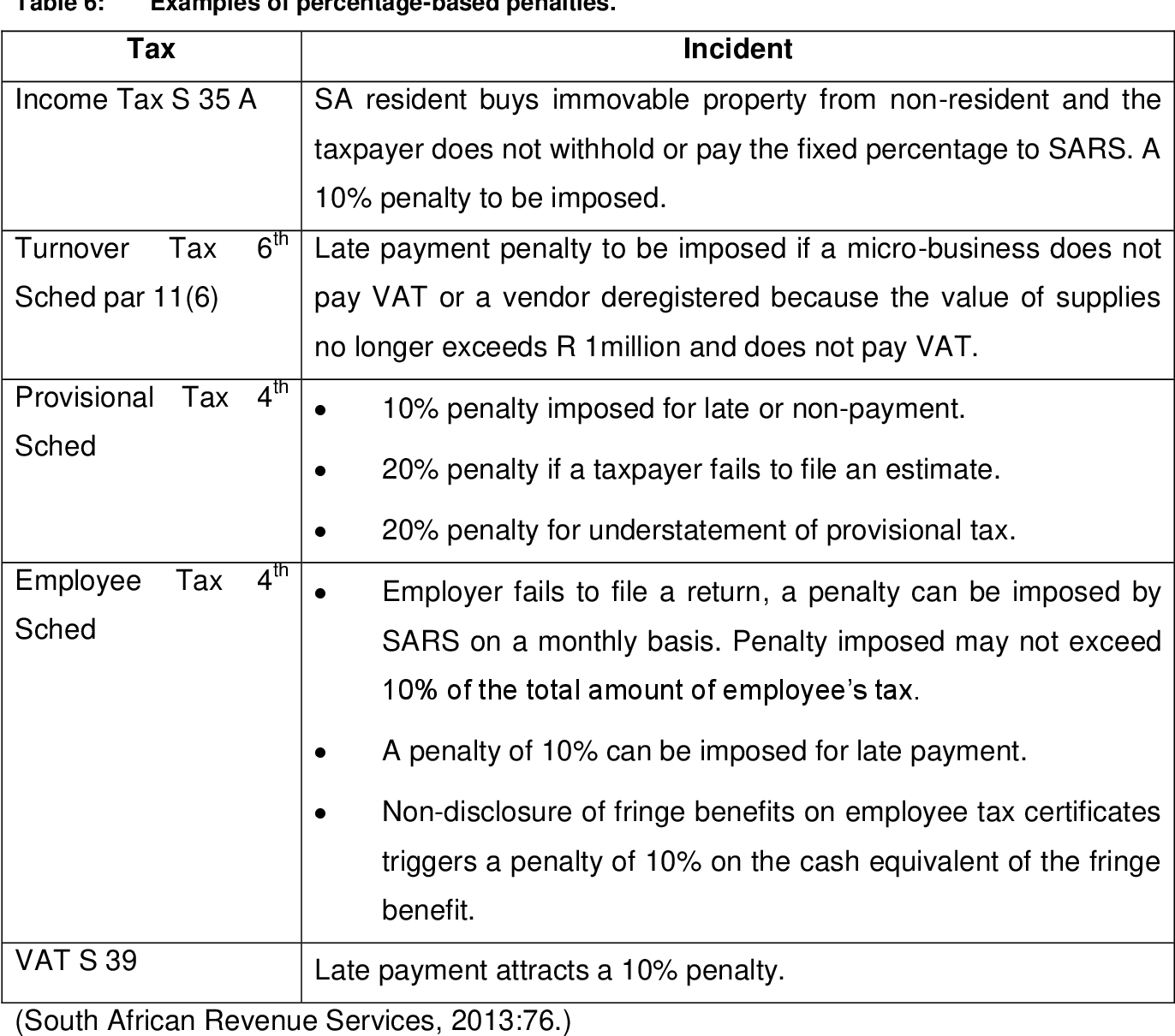

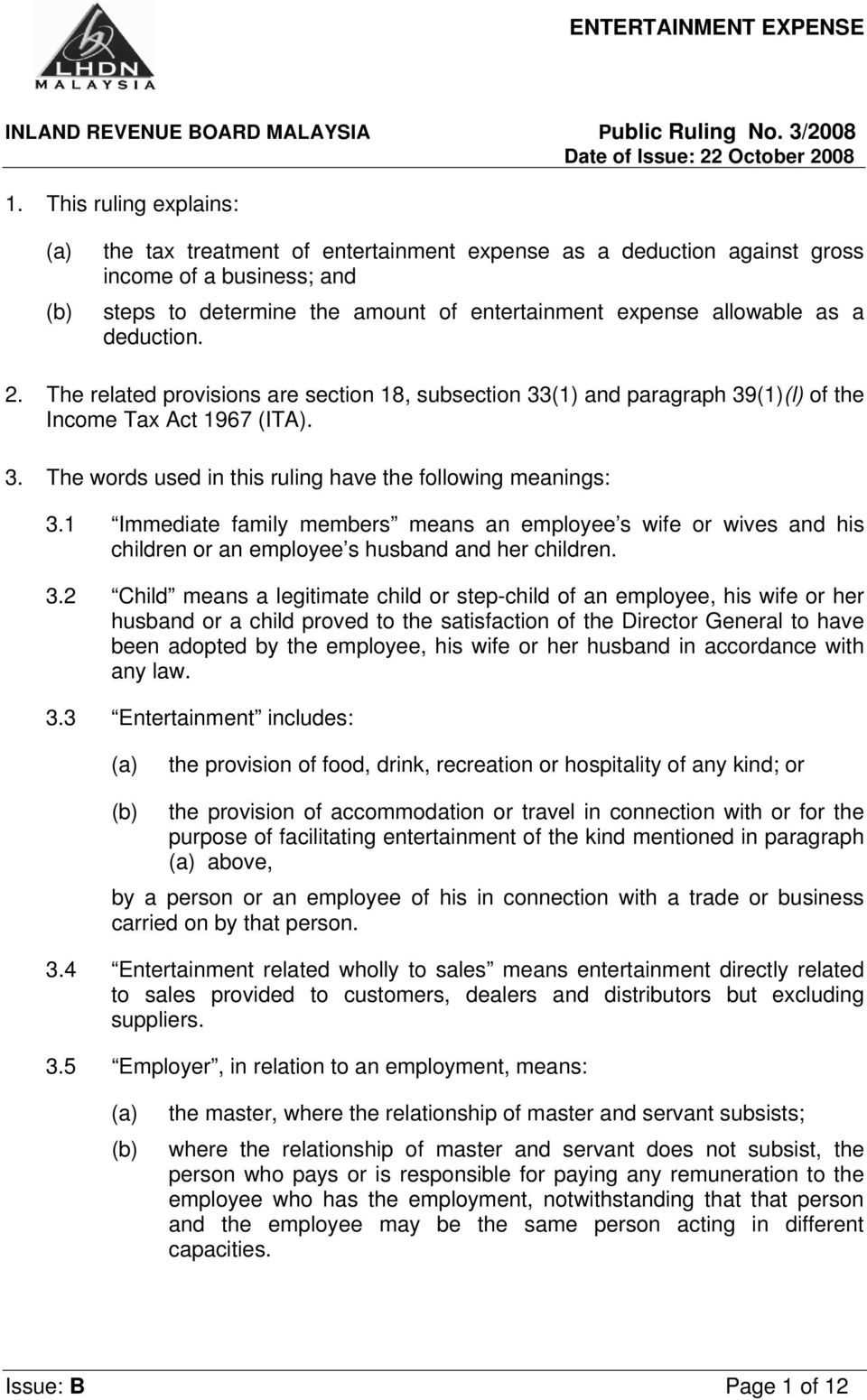

Section 39 1 income tax act. 1961 income tax department all acts income tax act 1961. The income tax department never asks for your pin numbers. 39 4 i in the case of a non resident any income by way of interest on such securities or bonds as the central government may by notification in the official gazette40 specify in this behalf including. This ruling explains the tax treatment of entertainment expense as a deduction against gross income from a business.

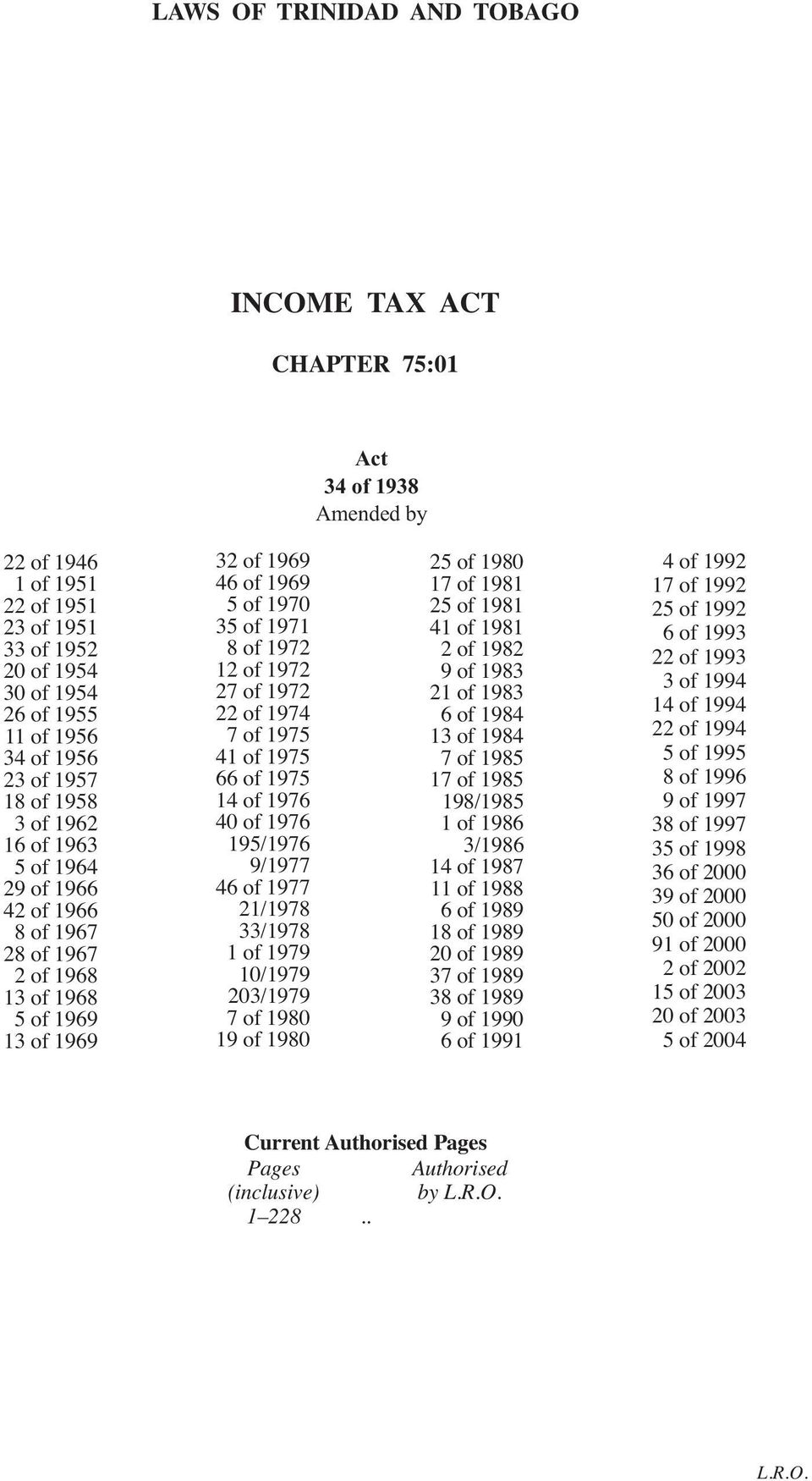

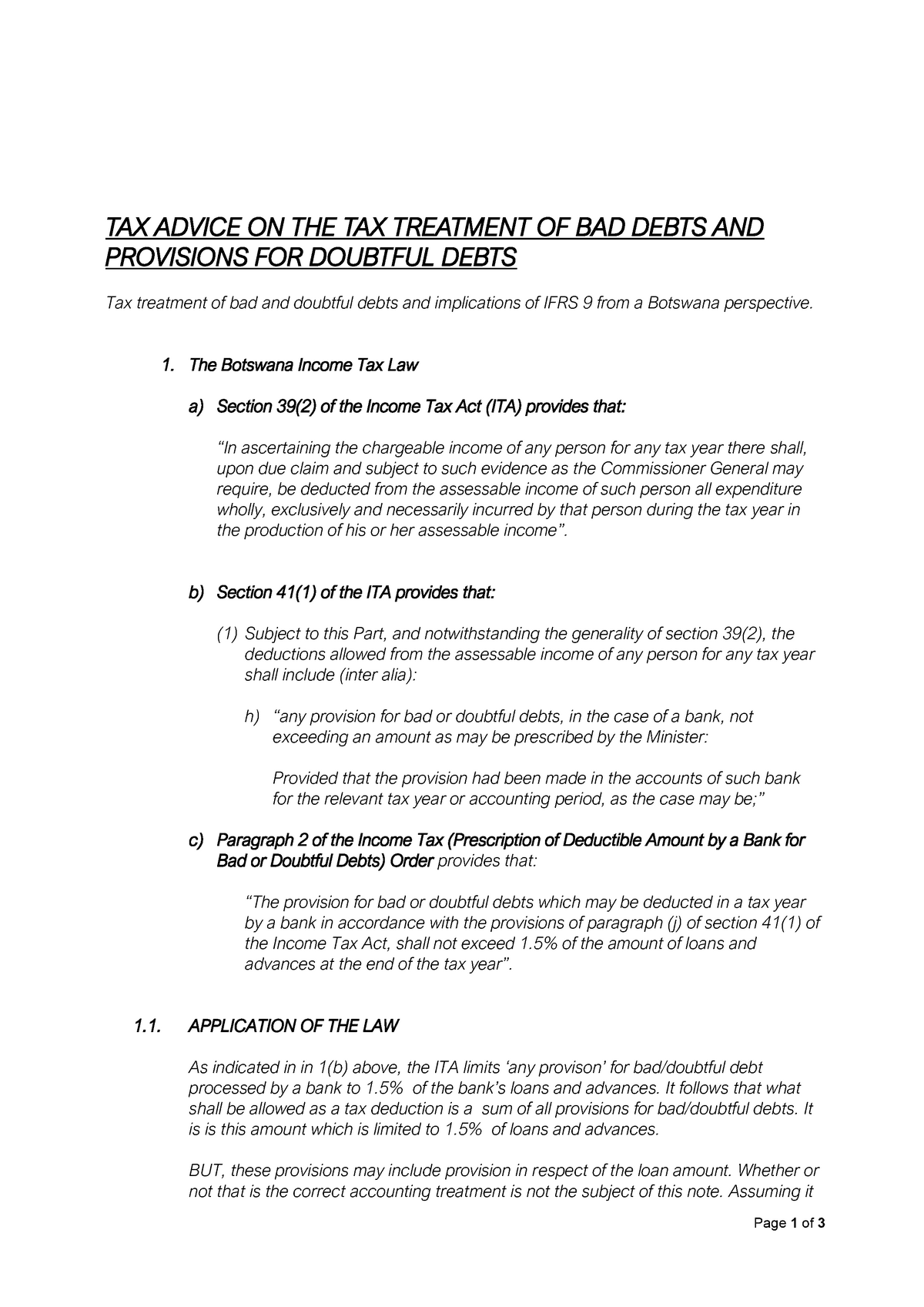

Income tax act c. Charge of income tax 3 a. Non chargeability to tax in respect of offshore business activity 3 c. Wealth tax not deductible in computing the total income for certain assessment years.

Income tax act part. B this act were read without reference to subsection 110 6 20 b is the total of all amounts each of which is the amount by which the individual s capital gain for a preceding taxation year determined without reference to subsection 39 1 2 from the disposition of an interest in or a share of the capital stock of the entity was reduced under that subsection. Interpretation part ii imposition and general characteristics of the tax 3. 1 subject to any express provision of this act in ascertaining the adjusted income of any person from any source for the basis period for a year of assessment no.

Except that where a particular amount was included under subparagraph 14 1 a v in the taxpayer s income for a taxation year that ended after 1987 and before 1990 the reference in subparagraph 39 9 b i 1 to 3 2 shall in respect of that portion of any amount deducted under section 110 6 in respect of the particular amount be. 1 in this act shall be deemed to be associated companies. The related provisions are section 18 subsection 33 1 paragraphs 39 1 l and m of the income tax act 1967 the act. 299 an act to impose a tax upon incomes and to regulate the 17 of 1929 7 of 1970 24 of 1969 25 of 1962 interpretation 22 of 1959 11 of 1962 31 of 1970 4 of 1972 25 of 1973 18 of 1980 2 of 1986 4 of 1986 5 of 1987 3 of 1995 13 of 1996 2.

Classes of income on which tax. Scope of total income. Act 53 income tax act 1967 arrangement of sections part i preliminary section 1. The words used in this ruling have the following meanings.

Part iii ascertainment of chargeable income chapter. Section 10 income tax act 1961 2015 chapter iii. Chapter 4 adjusted income and adjusted loss section. Short title and commencement 2.

These sections read as under 4.